Frische, Qualität und Nachhaltigkeit aus der Region

Alpenbrot ist Ihr Partner für authentische Bio-Lebensmittel in Bern und der ganzen Schweiz. Direkt vom Feld, mit Leidenschaft geliefert.

Unsere Leistungen entdeckenUnsere Philosophie: Vom Feld direkt auf Ihren Tisch

Unsere Leistungen für Sie

Grosshandel für Gastronomie & Handel

Zuverlässige Belieferung von Restaurants, Hotels und Einzelhändlern mit unserem gesamten Sortiment an frischen Bio-Produkten.

Direkt-zu-Ihnen Abo-Boxen

Erhalten Sie wöchentlich eine saisonale Auswahl der besten Produkte direkt nach Hause oder ins Büro geliefert. Flexibel und individuell.

Consulting & Sortimentsplanung

Wir beraten Unternehmen bei der Zusammenstellung nachhaltiger und regionaler Lebensmittelsortimente und optimieren Lieferketten.

Import & Export von Spezialitäten

Neben unserem regionalen Fokus beschaffen wir fair gehandelte Bio-Spezialitäten aus Europa, um Ihr Angebot einzigartig zu machen.

Transparenz, die man schmeckt: Lernen Sie unsere Partner kennen

Wir sind stolz auf unser Netzwerk aus leidenschaftlichen Schweizer Produzenten. Hier ist eine kleine Auswahl unserer Partner, die unsere Werte teilen.

Bio-Hof Müller, Thurgau

Spezialität: Knackige Äpfel & Birnen

Käserei Zürcher, Emmental

Spezialität: Würziger Alpkäse

Gemüsebau Fischer, Seeland

Spezialität: Saisonaler Salat & Wurzelgemüse

Ihre wöchentliche Dosis Frische: Die Alpenbrot Abo-Box

Stellen Sie sich vor, jede Woche eine Kiste voller saisonaler, frischer Bio-Überraschungen direkt an Ihre Haustür zu bekommen. Mit unseren flexiblen Abonnements – perfekt für Singles, Paare und Familien – ist gesunde Ernährung so einfach wie nie zuvor.

- Wöchentliche oder 14-tägige Lieferung

- Jederzeit pausier- oder kündbar

- Individuelle Präferenzen anpassbar

- Inklusive Rezeptinspirationen

Was unsere Partner und Kunden sagen

Nehmen Sie Kontakt auf

Haben Sie Fragen zu unseren Produkten, möchten Sie Partner werden oder eine Bestellung aufgeben? Wir freuen uns auf Ihre Nachricht.

Senden Sie uns eine Nachricht

Unsere Kontaktdaten

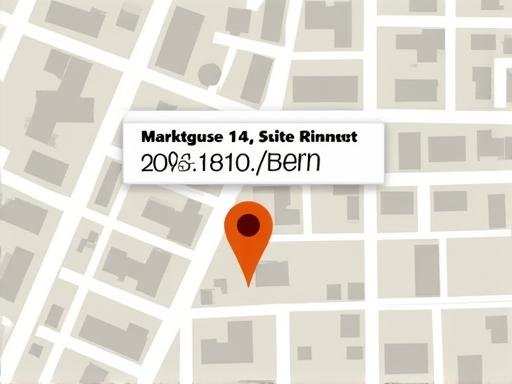

Adresse:

Alpenbrot Lebensmittelhandel

Marktgasse 14, Suite 201

3011 Bern

Schweiz

Telefon: +41 31 567 89 01

Email: info@alpenbrot.ch

Öffnungszeiten:

Mo - Fr: 08:00 - 18:00

Unser Standort in Bern